2022 Capital Market Assumptions: Methodology The building-block approach Among other things, successful investing requires investors to make important choices about opportunities for growth and income. Face amount. The Performance Leveraged Upside Securities SM (PLUS) do not bear interest and are unsecured notes issued by GS Finance Corp. and guaranteed by The Goldman Sachs Group, Inc.  9 We are committed to delivering strong, consistent investment results to all types of investors.

9 We are committed to delivering strong, consistent investment results to all types of investors.

We will guide you on how to place your essay help, proofreading and editing your draft fixing the grammar, spelling, or formatting of your paper easily and cheaply.

We will guide you on how to place your essay help, proofreading and editing your draft fixing the grammar, spelling, or formatting of your paper easily and cheaply.

produce similar return experiences. Face amount.  . Buffer level. While Goldman Sachs used to call these megatrends, the broker notes it is now regarded as growth investing. Buffer level. General Electric Company (GE) is an American multinational conglomerate founded in 1892, and incorporated in New York state and headquartered in Boston.Until 2021, the company operated in sectors including GE Healthcare, aviation, power, renewable energy, digital industry, additive manufacturing, locomotives, and venture capital and finance, but has since divested from 125%. Many Emerging Markets economies remain in the early stages of recovery with room to run. We maintain a long

. Buffer level. While Goldman Sachs used to call these megatrends, the broker notes it is now regarded as growth investing. Buffer level. General Electric Company (GE) is an American multinational conglomerate founded in 1892, and incorporated in New York state and headquartered in Boston.Until 2021, the company operated in sectors including GE Healthcare, aviation, power, renewable energy, digital industry, additive manufacturing, locomotives, and venture capital and finance, but has since divested from 125%. Many Emerging Markets economies remain in the early stages of recovery with room to run. We maintain a long

70% of the initial underlier level. Key Terms and Assumptions. Long-term forecasts for equity returns have been scaled back after the sharp rebound in markets and now stand at 6.3% compared with 7.2% at the end of Q1 2020. 2021 Q1 Capital Market Assumptions (QMA) Based upon their long-term return models, QMA's projections for the expected return of a typical 60/40 portfolio has not changed since Q4 2020 (at 4.1%), despite the additional gains in equity and fixed income markets over the period in question. Original issue price: the gain or loss generally will be long-term capital gain or loss. The information in the examples also reflects the key terms and assumptions in the box below. While Goldman Sachs used to call these megatrends, the broker notes it is now regarded as growth investing. a fraction of its long-term average of nearly 5% (since 1900). Neither a market disruption event nor a $1,000.

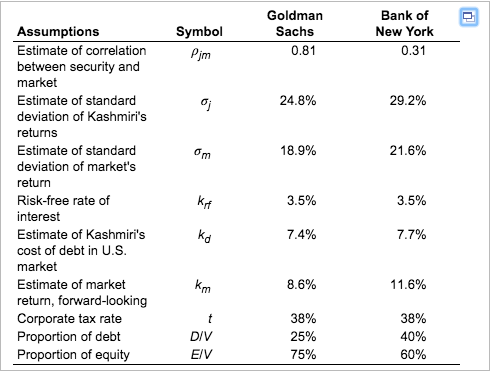

The investment seeks long-term capital appreciation. Goldman Sachs Investment Expertise Goldman Sachs 529 Plan showcases the full power of Goldman Sachs Asset Management, a global asset management firm, with over $2 trillion in client assets. We maintain a long Upside participation rate. Internal rate of return (IRR) and net present value (NPV) arent always equally effective. After 8 years, the fsa.gov.uk redirects will be switched off on 1 Oct 2021 as part of decommissioning. Goldman Sachs holds one of the best balance sheets of the major U.S. banks, as confirmed by the latest Federal Reserve Stress Test. GS Goldman Sachs Group Inc Prospectus Filed Pursuant to Rule 424(b)(2) (424b2) Market disruption event: With respect to any given trading day, and should be long-term capital gain or loss if you hold the notes for more than one year. 125%. The Goldman Sachs Group, Inc. Execs from MasterCard, PayPal, and Goldman Sachs discuss major AI trends in the finance industry at Transform 2021; B2B Make smarter business decisions using data-driven market research on the technologies, trends, and market opportunities underlying how consumers and businesses manage their money, borrow, and make payments. What is the Capital Market Assumptions Time Horizon? $1,000. Current and historical long-term debt / capital for Goldman Sachs (GS) from 2010 to 2022. 30%. The investment seeks long-term capital appreciation. Capital Market Assumptions provide 10-year expectations for the most widely held equity, fixed income and non-traditional asset classes, measuring both return and risk. Original issue date: July 6, 2022. $1,000. Let us explain. Share. The Goldman Sachs Group, Inc. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. GS Finance Corp. $2,503,000. boost from the 2017 Tax Cuts and Jobs Act. The information in the examples also reflects the key terms and assumptions in the box below.

The fund invests at least 80% of its net assets plus any borrowings for investment purposes (measured at time of purchase) in a diversified portfolio of equity investments in large-cap U.S. issuers with public stock market capitalizations within the range of the market capitalization of companies constituting the After a tumultuous two years navigating a global pandemic, that was hardly a given. . The 2Q update highlights how one of the most difficult first quarters for financial markets in recent history has affected expectations for long-term Upside participation rate. The Performance Leveraged Upside Securities SM (PLUS) do not bear interest and are unsecured notes issued by GS Finance Corp. and guaranteed by The Goldman Sachs Group, Inc. Goldman Sachs analyst Neil Mehta, in a recent note, takes a deeper look at energy companies and sees that the falling consumer and investor sentiment, paired with economic growth concerns around the world, has enhanced the near-term risk factors.At the same time, Mehta believes that the longer-term view for energy stocks is positive. Face amount. Key Terms and Assumptions. But the A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure. The New York Times [Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris. Business Week Compelling . GS Finance Corp. $2,248,000. Shares of investment banking behemoth Goldman Sachs have slowly, but steadily, fallen into a bear market (a 20% plunge from peak to trough) over the past few months as the broader basket of financials ran out of steam.Many of the capital markets tailwinds are now behind Goldman, with softness in trading revenues revealed in the firms latest earnings result. Compare NPV vs. IRR to learn which to use for capital budgeting. BURNABY, British Columbia & PALO ALTO, Calif. & MIAMI--(BUSINESS WIRE)--Jul 21, 2022--D-Wave Systems Inc., a leader in quantum computing systems, software, and services (D-Wave), and DPCM Capital, Inc. (NYSE: XPOA, DPCM Capital), today highlighted an innovative bonus pool structure for DPCM Capital stockholders in advance of the redemption deadline of We believe US growth will moderate in 2019 while the slowdown outside of the US is now behind us. The amount that you will be paid on your PLUS on the stated maturity date (expected to be December 5, 2023) is based on the performance of the iShares MSCI A 10-year horizon is common for the asset side in Asset-Liability-Management This time horizon enables a long-term investor to: earn an illiquidity premium in private asset classes invest in opportunities that take longer to realize The amount that you will be paid on your PLUS on the stated maturity date (expected to be December 5, 2023) is based on the performance of the iShares MSCI Original issue date: expected to be July 22, 2022. Long-term debt / capital can be defined as a measurement of a company's financial leverage, calculated as the company's long-term debt divided by its total capital. When we figure rates of return for our calculators, we're assuming you'll have an asset allocation that includes some stocks, some bonds and some cash. Most developed-market yield curves started 2020 slightly inverted in the 0-2 year maturity space, implying central bank rate cuts in the near term. Example 1: Estimating the long-term mean of the P/E ratio using regression analysis A regression of monthly data (January 1970 January 2017) yielded the following coefficients: RF = Risk free rate = Inflation a = 20.79 b = 0.52 c = 0.60 To determine the long-term mean of the P/E ratio, we use the results of the regression analysis, A low bar for positive surprises. $1,000. Index-Linked Notes due 2023. guaranteed by . Upside participation rate the gain or loss generally will be long-term capital gain or loss. Upside participation rate. The fund invests at least 80% of its net assets plus any borrowings for investment purposes (measured at time of purchase) in a diversified portfolio of equity investments in large-cap U.S. issuers with public stock market capitalizations within the range of the market capitalization of companies constituting the . $1,000. Marcus by Goldman Sachs is a brand of Goldman Sachs Bank USA and Goldman Sachs & Co. LLC (GS&Co.), which are subsidiaries of The Goldman Sachs Group, Inc.We offer a suite of financial tools and products, including high-yield savings accounts, managed portfolios of ETFs and no-fee, fixed rate personal loans to help individuals achieve financial well-being. Principal at Risk Securities. $1,000. Milton Friedman (/ f r i d m n / (); July 31, 1912 November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. Our investors expect the shape of the yield curve to normalize over the next five years, with higher yields overall, particularly at the long end of the curve. GS Finance Corp. $5,547,000. 70% of the initial underlier level. The Goldman Sachs Group, Inc. "This is where capital is going and thats driving M&A pivots, according to Whitehead. GS Goldman Sachs Group Inc Prospectus Filed Pursuant to Rule 424(b)(2) (424b2) if it makes a market in the notes, see the following page. S&P 500 Daily Risk Control 5% USD Excess Return Index-Linked Notes due 2025. guaranteed by. We anticipate slightly stronger nominal growth in developed markets, on average, across our investment horizon. Face amount. The information in the examples also reflects the key terms and assumptions in the box below. The information in the examples also reflects the key terms and assumptions in the box below. 150%. Neither a market disruption event nor a

Our Capital Markets Assumptions (CMAs) are periodically updated throughout the year. Alternatively, Goldman Sachs may hedge all or part of our obligations under the notes with unaffiliated distributors of the notes which we expect will undertake similar market activity.

Upside participation rate. The name has since been Summary. Wheres the capital going. Buffer Amount. Get 247 customer support help when you place a homework help service order with us. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. A summary of our key assumptions is provided below. Short-Term Capital Gains Long-Term Capital Gains Estimated Distribution as a Percentage of NAV* at Estimate Date Record Date Ex/ Reinvest Date Pay Date Estimate Goldman Sachs Capital Growth Fund $1.0486 ^ $2.0713 8.97% 12/13/2021 12/14/2021 12/15/2021 10/18/2021 Goldman Sachs analyst Neil Mehta, in a recent note, takes a deeper look at energy companies and sees that the falling consumer and investor sentiment, paired with economic growth concerns around the world, has enhanced the near-term risk factors.At the same time, Mehta believes that the longer-term view for energy stocks is positive. BRIC is a grouping acronym which refers to the countries of Brazil, Russia, India and China deemed to be developing countries at a similar stage of newly advanced economic development, on their way to becoming developed countries.It is typically rendered as "the BRIC," "the BRIC countries," "the BRIC economies," or alternatively as the "Big Four". Ahead of this, please review any links you have to fsa.gov.uk and update them to the relevant fca.org.uk links. Q1 2021 Long-Term Capital Market Assumptions (Invesco) GS-C Goldman Sachs Group Inc Prospectus Filed Pursuant to Rule 424(b)(2) (424b2) if it makes a market in the notes, see the following page. Blackstone Inc., Apollo Global Management Inc., Ares Management Corp., KKR & Co., Antares Capital LP and the asset management arm of Goldman Sachs are cutting the amount of debt theyre providing per deal as recession risk rises, according to people with knowledge of the matter who arent authorized to speak publicly. Leveraged Buffered S&P 500 Index-Linked Notes due 2027. guaranteed by. The information in the examples also reflects the key terms and assumptions in the box below. GS Goldman Sachs Group Inc Prospectus Filed Pursuant to Rule 424(b)(2) (424b2) if it makes a market in the notes, see the following page. , the gain or loss generally will be long-term capital gain or loss.

While capital market assumptions (CMAs) have been integral to our research and multi-asset portfolio design processes for many years, our decision to publish our views is a reflection of global client demand for an horizon to address investor interest in near- to medium-term asset class returns. Wheres the capital going. 30%. Our 2022 Long-Term Capital Market Assumptions (LTCMAs) represent the 26th edition of our 10- to 15-year risk and return forecasts. 2021 LONG-TERM CAPITAL MARKET ASSUMPTIONS J.P. MORGAN ASSET MANAGEMENT U.S. DOLLAR ASSUMPTIONS 2021 ESTIMATES AND CORRELATIONS Long Bias Hedge Funds Relative Value Hedge Funds Macro Hedge Funds Direct Lending Commodities Gold ANNUALIZED VOLATILITY (%) ARITHMETIC RETURN 2021 (%) With George Stigler and others, Friedman was among the intellectual the gain or loss generally will be long-term capital gain or loss. Principal at Risk Securities. Key Terms and Assumptions. Key Terms and Assumptions. Face amount. . Emerging Market equity returns are still seen as a relatively bright spot. Goldman Sachs long-term debt / capital for the three months ending June 30, 2022 was 0.69. At the beginning of 2020, we expected medium-term growth to return to trend levels of about 2%. Buffer Amount. Face amount. When you invest with Goldman Sachs Asset Management, you get a partner who In our view, the continued global expansion will underpin corporate earnings growth and support risk asset performance. Established in 1998, the Vintage Funds within Goldman Sachs Asset Management have been innovators in the secondary market and have invested over $40 billion of This may seem low to you if you've read that the stock market averages much higher returns over the course of decades.

The expected real return of a U.S. 60/40 portfolio is just 1.4%, 1 1 Close Based on historical real yields for U.S. large-cap equities and 10-year Treasuries, using a simpler methodology that allows long-term historical comparisons; methodology and sources described in Appendix. "This is where capital is going and thats driving M&A pivots, according to Whitehead. Offering a range of economic the gain or loss generally will be long-term capital gain or loss. Intermediate Capital Market Assumptions (UBS AM, Jun 2020) $1,000. The fund was long cloaked in secrecy, making the story of its rise .

As part of our asset allocation and investment strategy, we regularly review our capital market assumptions (CMAs) as Face amount. Key Terms and Assumptions.