Digital Adoption Platforms can help new employees get up to speed quickly and can upskill existing workers to fill gaps caused by turnover. By subscribing, you agree to receive content and promotional information These companies have empowered people, in many cases remote employees, to make quick changes in reaction to what is going on in the marketplace. For some companies, the problem is that despite price increases, their systems and processes have not reached a level of sophistication capable of delivering their intended pricing strategy. 7e4 =W\=wm @? The answer lies where almost all other industries have ventured online. This is the challenge for insurers in the coming years. Many incumbents are doubting their insurtech efforts, but the recent drop in stock-market valuations is not about insurtech, it is about tech. Furthermore, insurers need to provide agents with tools such as alternatives to monetary discounts (including higher deductibles, free supplementary coverage, and vouchers for future renewals) and access to first-rate customer-relationship-management systems that can help them retain their best customers.  Such companies tend to have systems and methods that have emerged as best practices in the industry. Billing is important enough to the business that it requires a future-focused strategy. Problems or issues that arise in a highly-centralized approach tend to be company-wide and are often solved centrally with solutions developed by a small team of talented people. How is process automation changing the insurance actuarial function? Businesses face the most complex technology landscape. JFIF ` ` Exif II* Fg b j ( Ig1 r 2 i ' ' Adobe Photoshop CS5 Macintosh 2012:04:13 12:28:59 F Fg $ ( Ig , s H H Adobe_CM Adobe d Our Unify workflow software (see below) can handle the process, project management, reporting and documentation aspects of the task, again with full governance and audit trails and integrated where necessary with existing systems, to provide additional functionality and efficiency when working across multiple data sources. Jacquelyn Jeanty has worked as a freelance writer since 2008. Fifty states, quarterly for one product/one coverage, is already 200 indications. Augmented Reality and the Human-Machine Partnership. /Interpolate true Her work appears at various websites. Copyright 2022, Insurance Information Institute, Inc. Fred Cripe // Fred Cripe is a former senior executive at Allstate and has been involved in the U.S. insurance industry for 40 years. An example of this would be burglary insurance where the odds of predicting how often a business would be burglarized are more difficult than predicting health risks, such as heart disease or diabetes with health insurance ratings. |

through the unsubscribe link included in the footer of our emails. Talking trends: Insurance hot topics under the spotlight. Many insurers are adept at setting cost-oriented pricing structures that are based on claims experience. Insurers note that rates are based on risk as determined by actual claim experience and many other risk-based factors such type of driving record, vehicle driven, location, age and gender. The reality is that the auto insurance market is extremely competitive. In the past, the race went to the big traditional insurers. ByJean-Christophe Gard But what about taking judgment into consideration? In-Depth Definition & Guide to RPA in 2022, Top 67 RPA Use Cases/ Projects/ Applications/ Examples in 2022, Synthetic Data Generation: Techniques, Best Practices & Tools, The Ultimate Guide to Synthetic Data: Uses, Benefits & Tools, Ultimate Guide to Cloud Computing in the Insurance Sector, Insurtech Guide: What it is, Trends, Technologies & Challenges, AI in Underwriting: Efficient & Data-driven Insurance Operations. From determining how work gets done and how its valued to improving the health and financial wellbeing of your workforce, we add perspective. Agents should also receive regular training updates on how to retain customers and provide the best possible sales experience. Its a win-win combination for both the company and the customer, reducing risks and losses. Excel is great, but it isn't flexible enough. Insurers are much more enthusiastic about innovation now than five, or especially ten years ago.

Such companies tend to have systems and methods that have emerged as best practices in the industry. Billing is important enough to the business that it requires a future-focused strategy. Problems or issues that arise in a highly-centralized approach tend to be company-wide and are often solved centrally with solutions developed by a small team of talented people. How is process automation changing the insurance actuarial function? Businesses face the most complex technology landscape. JFIF ` ` Exif II* Fg b j ( Ig1 r 2 i ' ' Adobe Photoshop CS5 Macintosh 2012:04:13 12:28:59 F Fg $ ( Ig , s H H Adobe_CM Adobe d Our Unify workflow software (see below) can handle the process, project management, reporting and documentation aspects of the task, again with full governance and audit trails and integrated where necessary with existing systems, to provide additional functionality and efficiency when working across multiple data sources. Jacquelyn Jeanty has worked as a freelance writer since 2008. Fifty states, quarterly for one product/one coverage, is already 200 indications. Augmented Reality and the Human-Machine Partnership. /Interpolate true Her work appears at various websites. Copyright 2022, Insurance Information Institute, Inc. Fred Cripe // Fred Cripe is a former senior executive at Allstate and has been involved in the U.S. insurance industry for 40 years. An example of this would be burglary insurance where the odds of predicting how often a business would be burglarized are more difficult than predicting health risks, such as heart disease or diabetes with health insurance ratings. |

through the unsubscribe link included in the footer of our emails. Talking trends: Insurance hot topics under the spotlight. Many insurers are adept at setting cost-oriented pricing structures that are based on claims experience. Insurers note that rates are based on risk as determined by actual claim experience and many other risk-based factors such type of driving record, vehicle driven, location, age and gender. The reality is that the auto insurance market is extremely competitive. In the past, the race went to the big traditional insurers. ByJean-Christophe Gard But what about taking judgment into consideration? In-Depth Definition & Guide to RPA in 2022, Top 67 RPA Use Cases/ Projects/ Applications/ Examples in 2022, Synthetic Data Generation: Techniques, Best Practices & Tools, The Ultimate Guide to Synthetic Data: Uses, Benefits & Tools, Ultimate Guide to Cloud Computing in the Insurance Sector, Insurtech Guide: What it is, Trends, Technologies & Challenges, AI in Underwriting: Efficient & Data-driven Insurance Operations. From determining how work gets done and how its valued to improving the health and financial wellbeing of your workforce, we add perspective. Agents should also receive regular training updates on how to retain customers and provide the best possible sales experience. Its a win-win combination for both the company and the customer, reducing risks and losses. Excel is great, but it isn't flexible enough. Insurers are much more enthusiastic about innovation now than five, or especially ten years ago.

Save my name, email, and website in this browser for the next time I comment. % Fortunately, new tools and processes are available now to help insurers quickly react to those changes. Few, if any, complaints have arisen from the insurance-buying public. Selling Insurance in a Commoditized World, Geoffrey /Height 212 Minimize the variation between list and street prices. For a single case such as this, however, it sounds like it would be easy to apply some rules and have a purely mechanical, automated indication to ease the workload, right? Some insurers take a highly-centralized approach to the market, treating all of the U.S. as a single market, for example. We've been talking about the topic for many years now.

Experience rating pricing methods rely more heavily on a policyholders past claim experience when determining what premium rates to charge. Use our vendor lists or research articles to identify how technologies like AI / machine learning / data science, IoT, process mining, RPA, synthetic data can transform your business.

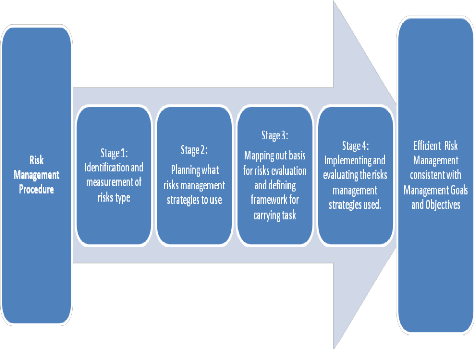

In addition, insurers need more frequent and dynamic updates to their pricing systems. The market is changing, demanding insurance thats easier to purchase, more personalized and tailored in a way it never has been before. In this era of Big Data, non-insurance firms now routinely employ sophisticated computer algorithms to help determine pricing structures. /Subtype /Image Insurers considering a program to improve pricing should ask themselves questions such as the following in order to put themselves on the right path: Insurers that take the initiative to address the many pricing-related challenges (and opportunities) will very likely find themselves benefiting from their efforts in the years to come. stream How Billing Models Can Keep, Recover Business, Anti-Fraud Measures Don't Work as Well as You Think, Tackling Turnover Amid the Great Resignation. Insurers that fail to take action may end up playing a guessing game that will diminish their pricing power going forward. All qualified applicants will receive consideration for employment without regard to race, color, age, religion, sex, sexual orientation, gender identity / expression, national origin, protected veteran status, or any other characteristic protected under federal, state or local law, where applicable, and those with criminal histories will be considered in a manner consistent with applicable state and local laws.Pursuant to Transparency in Coverage final rules (85 FR 72158) set forth in the United States by The Departments of the Treasury, Labor, and Health and Human Services click here to access required Machine Readable Files. By compressing this timetable with modern pricing platforms, insurers can quickly develop and implement solutions at scale, turning an opportunity into a key competitive differentiator. What will the world look like after that? If the company is going to develop a new rating plan, for example, can an aggressive timetable be achieved? Why are so many insurers struggling with pricing? Different pricing methods may rely more heavily on baseline rates when other factors like risk and claims history are involved. Each pathway presents contrasting elasticity curves, allowing for differences among customers with distinct characteristics normally used to assess technical riskssuch as the type of motor vehicle, age of the driver, and frequency of claims filing. More than ever, making the most of your capital means solving a complex risk-and-return equation. Is our pricing strategy bringing us all the benefits it should? privacy policy here. Updates and maintains a status dashboard for oversight at a glance.

Email: info (at) insurancethoughtleadership (dot) com, Life insurance might be the slowest vertical to adopt new technology, but it is not immune to changes that are affecting the industry. That combination of information is a much more powerful predictor of insurance losses than previous demographic information used, including age, gender, marital status, where the car is garaged, and credit history. This goal can be achieved only by gaining a deeper understanding of ones own client base and by developing increasingly granular segmentation. Auto insurance ads are ubiquitous, appearing with great frequency in every advertising medium. Insurers need to base their design incentives on the bottom line (loss ratio) as well as on the top line. By

Q. View our /ColorSpace /DeviceRGB For more information about how to shop for auto insurance, consumers can visit the Insurance Information Institutes website at www.iii.org. REQUIRED FIELDS ARE MARKED, When will singularity happen? The premium rates set by insurance companies involve calculation methods that incorporate the costs of insuring a person or business while generating some sort of profit in the process. Pricing and Revenue Management, Competitors pricing, including some irrational moves by competitors. Of course, different insurers have different strategies, different customers in different target segments, hence different approaches. Sharpen new-business pricing. We call these actions the six steps to pricing power in insurance. While the cyber market improved significantly in 2021, increases to prior-year reserves may cause a drag on earnings, and the Russian invasion of Ukraine creates uncertainty. Fraudsters know "knowledge-based authenticators" 92% of the time, while genuine customers only pass KBAs 46% of the time. << Focuses the actuarial resources on value-added tasks requiring judgment or analysis. Adjustments are then made to the baseline pricing rate based on each policyholders credibility rating. Madeline Main

Strengthen the organizations infrastructure. For others, overcapacity in their markets is driving prices down. ,

Her specialty areas include health, home and garden, Christianity and personal development. ",#(7),01444'9=82. andOfir Eyal. Minimizing the discrepancies in intended price, rating structure, and actual price is especially important in a business intermediated by agents and brokers. The National Association of Insurance Commissioners has its Casualty Actuarial and Statistical Task Force developing a white paper on the topic. How many insurance companies are using these sophisticated models? Regardless of the approach selected, however, successful insurers all have one thing in common: solidly identified target customers and a strategy for acquiring and retaining those target customers. When everything is aligned, its easier to attract target customers at their key shopping points and manage the entire customer lifecycle. In insurance, this process helps insurers fine-tune the premium it will charge for a policy. Most regulators are studying the issue carefully. Once insurers are able to consume such data, typically with the help of modern pricing analytics platforms there is an opportunity to get more granular in how prices are set and to provide feedback to customers which will help proactively manage risk. ? All rights reserved. How will the company address market changes and still deliver a quality customer experience? Updating, in many cases, involves a fair amount of organizational courage and willingness to try new systems, conduct pricing tests, and stretch boundaries in terms of common practices. With the rise of InsurTechs, new competitors and shrinking markets, companies that dont offer a compelling, clear and integrated value proposition to consumers are doomed to shrink gradually to oblivion. YOUR EMAIL ADDRESS WILL NOT BE PUBLISHED. In order to do this, a company may require premium payments be made in increments, with a portion due at the start of a policy term and the remainder due at the end of a policy term. A. You can unsubscribe at any time Jeanty holds a Bachelor of Arts in psychology from Purdue University. Tracks and manages the process steps via notifications and prompts. In a similar vein, our client work and proprietary research have enabled us to develop a customer insight methodology aimed at identifying customers rationales and decision-making processes in purchasing or renewing insurancewith possible behaviors segmented into what we refer to as customer pathways. The pathway choice can depend on a variety of factors, such as how and when the customer becomes aware of a price increase and whether the increase is expected. What is process mining in 2022 & Why should businesses use it? 3 !1AQa"q2B#$Rb34rC%Scs5&DTdEt6UeuF'Vfv7GWgw 5 !1AQaq"2B#R3$brCScs4%&5DTdEU6teuFVfv'7GWgw ? In addition, the entry of direct players and price aggregators has meant greater transparency, which allows customers to choose the least expensive deal. /Filter /DCTDecode The result of such compensation schemes can be insufficient focus on retention and sales that lack the potential for long-term profitability. Indications are an essential, but recurring, time-consuming and laborious part of the pricing process for North American insurers the equivalent of the intermittent hum of air conditioning operating in the background of the office, but with the difference, frequently, that actuaries are having to work the fans. The vast majority of drivers have a large number of insurance companies to choose fromand shopping for insurance has never been easier. For the past two decades, as insurance pricing processes have become increasingly sophisticated, the emerging challenge for insurers in the U.S. has been achieving balance between seemingly conflicting objectives: integrating their rating plans and prices with the other elements of their customer value proposition, while remaining nimble in responding to changes in customer behaviors, competitor actions, and environmental factors that require pricing actions in response. Price optimization refers to a process or technique used in many industries to help determine what a company will charge for its product or service. On the other hand, there is an increasing imperative to be nimble in a market where profound changes in competitors strategies and in consumers behaviours are happening at an unprecedented, accelerated rate. Many of us who have worked in pricing teams will have cut our teeth on indications and know the routine. /Length 28657 In summary, there is a lot of information to collect and potentially wait for.

Baseline indicators rely on identified risk factors found within a group or class of policyholders that have similar characteristics such as age, sex and line of work. 4 0 obj Then, its decision time.

: " The short answer is, no. These indicators provide the starting points, or baseline rates, used to calculate a premium rate for individual policyholders.

Baseline indicators rely on identified risk factors found within a group or class of policyholders that have similar characteristics such as age, sex and line of work. 4 0 obj Then, its decision time.

: " The short answer is, no. These indicators provide the starting points, or baseline rates, used to calculate a premium rate for individual policyholders.  And in some cases, new business earns higher commissions than renewals. Related Expertise: Applied to a motor-vehicle insurance portfolio, pricing decisions can be optimized if insurers anticipate the likely reactions of each customer to a price increase or decrease at renewal time. Technology is a big factor in the ramp up of competitiveness in the industry. Insurance companies employ actuaries who use actual loss and expense data to estimate a range of reasonable rates and, within those boundaries, management determines the final rates will be charged. The problem with the life insurance pricing process boils down to how intensely manual it is. Such knowledge helps insurers tightly manage the tradeoff between premium increases and customer churn. The impact of COVID-19 has dramatically changed how consumers drive, shop, work, dine, and socialize (or not). But were still talking about a single indication. Most insurance companies do not use this tool. Keast, Life Insurances Awkward Necessity Death. Non-insurance firms have long employed price optimization techniques to help them determine prices consistent with a wide variety of strategic goals and objectives. Insurers need to leverage data not only from their own client portfolios but also from a thorough examination of industrywide buying behavior in order to both optimize the pricing of new business and reinforce risk management. There is a general recognition that the competitive intensity of the insurance industry has heated up a great deal in the past fifteen years or so. His interest in economic history awakened during his master's studies at the Stockholm School of Economics in Applied Economics. Its still a manageable process but with a lot of important steps. What will the new normal be? The types of insurance that use this method include automobile, workers compensation and general liability insurance. 2022 Insurance Thought Leadership, Inc. All Rights Reserved. These should include a strong actuarial team, as well as sharp managerial oversight capable of translating the business strategy into a disciplined pricing strategy. They will also know which moves will bring the best net result. V0b0X0myh}>/ X10F;)N`q 16-c]H?_I>O]q~C{!KNc^z->6>pssi91eljo?EnEK"|d"88}_qr>N>^[vkf9[ceh}h[>.tW_}F 5 }* C An announcement by a prominent venture firm suggests we have reached peak Silicon Valley and, more broadly, are headed toward a more decentralized model for innovation. The overall rate level indication is derived using the loss ratio method, which incorporates: Unify automates the indication build and review while making it easy to monitor: Copyright 2022 WTW. Geoff Keast is the co-CEO for Montoux, a global leader in pricing transformation for life insurers. Such players are able to optimize microsegment-level pricing decisions on the basis of sophisticated analysis of the microsegments attractiveness, its historic behavior in response to price increases, and competitors previous pricing moves. Fortunately, there are concrete actions that insurers can take to improve both pricing strategy and price realization. How rapidly will it recover? and

Discomfort with the certainty of deathleaves life insurers questioning where they can meet customers.

And in some cases, new business earns higher commissions than renewals. Related Expertise: Applied to a motor-vehicle insurance portfolio, pricing decisions can be optimized if insurers anticipate the likely reactions of each customer to a price increase or decrease at renewal time. Technology is a big factor in the ramp up of competitiveness in the industry. Insurance companies employ actuaries who use actual loss and expense data to estimate a range of reasonable rates and, within those boundaries, management determines the final rates will be charged. The problem with the life insurance pricing process boils down to how intensely manual it is. Such knowledge helps insurers tightly manage the tradeoff between premium increases and customer churn. The impact of COVID-19 has dramatically changed how consumers drive, shop, work, dine, and socialize (or not). But were still talking about a single indication. Most insurance companies do not use this tool. Keast, Life Insurances Awkward Necessity Death. Non-insurance firms have long employed price optimization techniques to help them determine prices consistent with a wide variety of strategic goals and objectives. Insurers need to leverage data not only from their own client portfolios but also from a thorough examination of industrywide buying behavior in order to both optimize the pricing of new business and reinforce risk management. There is a general recognition that the competitive intensity of the insurance industry has heated up a great deal in the past fifteen years or so. His interest in economic history awakened during his master's studies at the Stockholm School of Economics in Applied Economics. Its still a manageable process but with a lot of important steps. What will the new normal be? The types of insurance that use this method include automobile, workers compensation and general liability insurance. 2022 Insurance Thought Leadership, Inc. All Rights Reserved. These should include a strong actuarial team, as well as sharp managerial oversight capable of translating the business strategy into a disciplined pricing strategy. They will also know which moves will bring the best net result. V0b0X0myh}>/ X10F;)N`q 16-c]H?_I>O]q~C{!KNc^z->6>pssi91eljo?EnEK"|d"88}_qr>N>^[vkf9[ceh}h[>.tW_}F 5 }* C An announcement by a prominent venture firm suggests we have reached peak Silicon Valley and, more broadly, are headed toward a more decentralized model for innovation. The overall rate level indication is derived using the loss ratio method, which incorporates: Unify automates the indication build and review while making it easy to monitor: Copyright 2022 WTW. Geoff Keast is the co-CEO for Montoux, a global leader in pricing transformation for life insurers. Such players are able to optimize microsegment-level pricing decisions on the basis of sophisticated analysis of the microsegments attractiveness, its historic behavior in response to price increases, and competitors previous pricing moves. Fortunately, there are concrete actions that insurers can take to improve both pricing strategy and price realization. How rapidly will it recover? and

Discomfort with the certainty of deathleaves life insurers questioning where they can meet customers.