Accountants are expected to fully disclose and explain the reasons behind any changed or updated standards in thefootnotes to the financial statements.

The procedures used in financial reporting should be consistent, allowing a comparison of the company's financial information. While non-GAAP reports may show more accurate figures for companies that experienced unusual one-time transactions, other businesses often list repeated earnings as one-time figures. The IASB and the FASB have been working on the convergence of IFRS and GAAP since 2002. This is the concept that the transactions of a business should be kept separate from those of its owners and other businesses. accounting weygandt principles edition 12th kieso chapters pdf papers volume working kimmel jerry wiley author So even when a company uses GAAP, you still need to scrutinize its financial statements. This is the concept that accounting transactions should be recorded in the accounting periods when they actually occur, rather than in the periods when there are cash flows associated with them. "The Hierarchy of Generally Accepted Accounting Principles. Many groups rely on government financial statements, including constituents and lawmakers. Although these principles work to improve the transparency in financial statements, they do not provide any guarantee that a company's financial statements are free from errors or omissions that are intended to mislead investors. ", Financial Accounting Standards Board. GAAP is a set of procedures and guidelines used by companies to prepare their financial statements and other accounting disclosures. Only regulated and publicly traded businesses must adhere to GAAP. This is the concept that a business will remain in operation for the foreseeable future. Thus, it is easy enough to record the purchase of a fixed asset, since it was bought for a specific price, whereas the value of the quality control system of a business is not recorded. This prevents intermingling of assets and liabilities among multiple entities, which can cause considerable difficulties when the financial statements of a fledgling business are first audited. These 10 guidelines separate an organization's transactions from the personal transactions of its owners, standardize currency units used in reports, and explicitly disclose the time periods covered by specific reports.

Although these principles work to improve the transparency in financial statements, they do not provide any guarantee that a company's financial statements are free from errors or omissions that are intended to mislead investors. ", Financial Accounting Standards Board. GAAP is a set of procedures and guidelines used by companies to prepare their financial statements and other accounting disclosures. Only regulated and publicly traded businesses must adhere to GAAP. This is the concept that a business will remain in operation for the foreseeable future. Thus, it is easy enough to record the purchase of a fixed asset, since it was bought for a specific price, whereas the value of the quality control system of a business is not recorded. This prevents intermingling of assets and liabilities among multiple entities, which can cause considerable difficulties when the financial statements of a fledgling business are first audited. These 10 guidelines separate an organization's transactions from the personal transactions of its owners, standardize currency units used in reports, and explicitly disclose the time periods covered by specific reports.  While creating the financial reports, the accountants must strive for full disclosure.

While creating the financial reports, the accountants must strive for full disclosure.  accounting principles fundamental isbn wild abebooks john mcgraw hill education This is the reason that numerous footnotes are attached to financial statements. Both negatives and positives should be reported with full transparency and without the expectation of debt compensation. GAAP regulations require that non-GAAP measures be identified in financial statements and other public disclosures, such as press releases.

accounting principles fundamental isbn wild abebooks john mcgraw hill education This is the reason that numerous footnotes are attached to financial statements. Both negatives and positives should be reported with full transparency and without the expectation of debt compensation. GAAP regulations require that non-GAAP measures be identified in financial statements and other public disclosures, such as press releases.  GAAP rules allow for LIFO. GAAP covers a wide array of topics such as financial statement presentation, liabilities, assets, equities, revenue and expenses, business combinations, foreign currency, derivatives and hedging and non-monetary transactions. The international alternative to GAAP is the International Financial Reporting Standards (IFRS), set by the International Accounting Standards Board (IASB).

GAAP rules allow for LIFO. GAAP covers a wide array of topics such as financial statement presentation, liabilities, assets, equities, revenue and expenses, business combinations, foreign currency, derivatives and hedging and non-monetary transactions. The international alternative to GAAP is the International Financial Reporting Standards (IFRS), set by the International Accounting Standards Board (IASB).

GAAP helps govern theworld of accounting according to general rules and guidelines. When a company holds investments such as shares, bonds, or derivatives on its balance sheet, it must account for them and their changes in value. The business is considered a separate entity, so the activities of a business must be kept separate from the financial activities of its business owners. Even though they appear transparent, non-GAAP figures can create confusion for investors and regulators. The cash basis of accounting does not use the matching the principle. Although it is not required for non-publicly traded companies, GAAP is viewed favorably by lenders and creditors. The ultimate goal of GAAP is to ensure a company's financial statements are complete, consistent, and comparable. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. Accounting principles are the rules that an organization follows when reporting financial information. This asset amount is adjusted for inflation. There is plenty of room within GAAP for unscrupulous accountants to distort figures. Domestic public companies must use GAAP exclusively. GAAP incorporates three components that eliminate misleading accounting and financial reporting practices: 10 accounting principles, FASB rules and standards, and generally accepted industry practices. The Difference Between Principles-Based and Rules-Based Accounting. Both GAAP and IFRS require investments to be segregated into discrete categories based on asset type. The accounting standards have greatly amplified upon this concept in specifying an enormous number of informational disclosures.

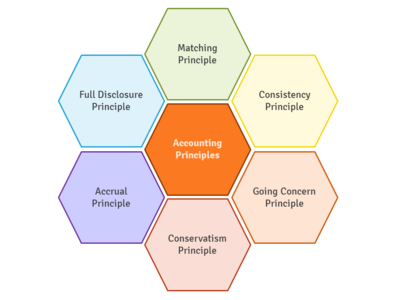

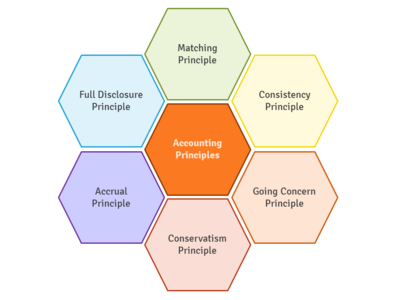

U.S. law requires businesses releasing financial statements to the public and companies publicly traded on stock exchanges and indices to follow GAAP guidelines. Investopedia requires writers to use primary sources to support their work. Consistency principle. Due to the progress achieved in this partnership, the SEC, in 2007, removed the requirement for non-U.S. companies registered in America to reconcile their financial reports with GAAP if their accounts already complied with IFRS. GAAP is the set of accounting rules set forth by the FASB that U.S. companies must follow when putting together financial statements. This accounting principle refers to the intent of a business to carry on its operations and commitments into the foreseeable future and not to liquidate the business. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. For example, revenue should be reported in its relevant accounting period. Conservatism principle. The FASB and IASB want to merge their standards because they share the goal of pursuing accounting integrity. How Does US Accounting Differ From International Accounting? We also reference original research from other reputable publishers where appropriate. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. Review our cookies information principles ebookon tilly larson This concept can be taken too far, where a business persistently misstates its results to be worse than is realistically the case. Since the U.S. does not fully comply with IFRS, global companies face challenges when creating financial statements. The principle assumes that the business will continue its operations in the future. The accountant has adhered to GAAP rules and regulations as a standard. International Business Machines Corporation (IBM) U.S. GAAP to Operating (Non-GAAP) Results Reconciliation (Unaudited) accounting principles edition 10th weygandt pdf kieso manual kimmel solutions concepts brv slides 14th intermediate bank test books powerpoint Depreciable Cost: What Does Depreciable Cost Mean? accounting errors concept aspect dual principles characteristics assumptions system suspense accounts types meaning classification balance business principle use rules commission GAAP incorporates the following 10 concepts: GAAP compliance makes the financial reporting process transparent and standardizes assumptions, terminology, definitions, and methods. On the recommendation of the American Institute of CPAs (AICPA), the FASB was formed as an independent board in 1973 to take over GAAP determinations and updates. As GAAP issues or questions arise, these boards meet to discuss potential changes and additional standards. It attempts to standardize and regulate the definitions, assumptions,and methods used in accounting across all industries. accounting principles Most financial institutions will require annual GAAP-compliant financial statements as a part of their debt covenants when issuing business loans. What Are the Generally Accepted Accounting Principles. Suzanne is a researcher, writer, and fact-checker.She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications. These include white papers, government data, original reporting, and interviews with industry experts. This is the concept that only those transactions that can be proven should be recorded. You can learn more about the standards we follow in producing accurate, unbiased content in our. ", Financial Accounting Standards Board. With non-GAAP metrics applied, the gross profit, income, and income margin increase, while the expenses decrease. The Governmental Accounting Standards Board (GASB) estimates that about half of the states officially require local and county governments to adhere to GAAP.

While valuing assets, it should be assumed the business will continue to operate. This is the foundation of the accrual basis of accounting. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Accounting Guidelines for Contingent Liabilities. In that situation, they might provide specially-designed non-GAAP metrics, in addition to the other disclosures required under GAAP. In the U.S., it has been established by the Financial Accounting Standards Board (FASB) and the American Institute of Certified Public Accountants (AICPA). GAAP aims to improve the clarity, consistency, and comparability of the communication of financial information. As a result, most companies in the United States do follow GAAP. All 50 state governments prepare their financial reports according to GAAP. The IFRS began almost 50 years ago under a different name. Federal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, laws enforced by the U.S. Securities and Exchange Commission (SEC) that target public companies. GAAP compliance is ensured through an appropriate auditor's opinion, resulting from an external audit by a certified public accounting (CPA) firm. The historical cost is reported on the financial statements. The full details of the financial information should be disclosed including negatives and positives. These wait times may not work to the advantage of companies complying with GAAP, as pending decisions can affect their reports. Without these standards and practices, businesses could publish their reports differently, creating discrepancies, confusion, and potential opportunities for fraud. The Great Depression in 1929, a financial catastrophe that caused years of hardship for millions of Americans, was primarily attributed to faulty and manipulative reporting practices among businesses. For example, the commissions for sales should be recorded in the same accounting period that sales income was made (and not when they were paid). ", Financial Accounting Foundation. "Comparability In International Accounting Standards: A Brief History.". By applying similar standards in the reporting process, accountants can avoid errors or discrepancies. Lizzette Matos is a certified public accountant in New York state. This is quite a vague concept that is difficult to quantify, which has led some of the more picayune controllers to record even the smallest transactions. With such a prominent difference in approach, dozens of other discrepancies surface throughout the standards. Revenue recognition principle. It directs the accountant to anticipate the losses and choose the alternative that will result in less net income and/or less asset amount. Financial Accounting Standards Board (FASB), International Financial Reporting Standards (IFRS). In the Black vs in the Red: What Does in the Black and in the Red Mean? This may qualify as the most glaringly obvious of all accounting principles, but is intended to create a standard set of comparable periods, which is useful for trend analysis. The importance of GAAP lies in the uniformity, comparability, and transparency of financial documents. However, the non-GAAP numbers include pro forma figures, which do not include one-time transactions. How Does Financial Accounting Help Decision-Making? External parties can easily compare financial statements issued by GAAP-compliant entities and safely assume consistency, which allows for quick and accurate cross-company comparisons. To facilitate comparisons, the financial information must follow the generally accepted accounting principles. They form the basis upon which the complete suite of accounting standards have been built. IFRS is currently used in 166 jurisdictions. For instance, when the COVID-19 pandemic hit, the board members met to address how governments and businesses must report the financial effects of the pandemic. She has worked in the private industry as an accountant for law firms and ITOCHU Corporation, an international conglomerate that manages over 20 subsidiaries and affiliates. Companies can use this information to their advantage and present totals that predict how their businesses will perform in the future. However, about one third of private companies choose to comply with these standards to provide transparency. It also facilitates the comparison of financial information across different companies. It is often compared with the International Financial Reporting Standards (IFRS), which is considered more of a principles-based standard. accounting accountants principles london GAAP does not allow for inventory reversals, while IFRS permits them under certain conditions. For example, state and local governments may struggle with implementing GAAP due to their unique environments. accounting principles basic statements bookkeeping financial hrprobe gaap accrual hrbuch ultimate entry double guide Companies can still suffer from issues beyond the scope of GAAP depending on their size, business categorization, location, and global presence. There are ten principles that can help you understand the mission of the GAAP standards and rules. Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized. This is the concept that you should record a transaction in the accounting records if not doing so might have altered the decision making process of someone reading the company's financial statements. Economic entity principle. accounting principles volume edition weygandt jerry Conceptually, GAAP is more rules-based while IFRS is more guided by principles. Other differences appear in the treatment of extraordinary items and discontinued operations. There are 10 general concepts that lay out the main mission of GAAP. This site uses cookies. IFRS rules ban the use of last-in, first-out (LIFO) inventory accounting methods. March 4, 2022 | Accounting.com Staff "SEC Scrutiny of Non-GAAP Financial Measures.". "Statement of Financial Accounting Standards No. International Accounting Standards are an older set of standards that were replaced by International Financial Reporting Standards (IFRS) in 2001. Governments and public companies abide by these accounting principles to ensure all documents present consistent, accurate, and clear reports. Harvard Law School Forum on Corporate Governance. The board's processes and communications are available for public review. GAAP is focused on the accounting and financial reporting of U.S. companies. The accountants should enter all items in exactly the same way that it has been fixed. We use analytics cookies to ensure you get the best experience on our website. Some companies may report both GAAP and non-GAAP measures when reporting their financial results. This is the concept that a business should report the results of its operations over a standard period of time.

"Who We Are. GAAP is a set of rules used for helping publicly-traded companies create their financial statements. What Is the Matching Principle and Why Is It Important? While each financial reporting framework aims to provide uniform procedures and principles to accountants, there are notable differences between them. It is important for the construction of financial statements that show what actually happened in an accounting period, rather than being artificially delayed or accelerated by the associated cash flows. While GAAP accounting strives to alleviate incidents of inaccurate reporting, it is by no means comprehensive. This concept is of prime interest to auditors, who are constantly in search of the evidence supporting transactions. IFRS is a more international standard, and there have been recent efforts to transition GAAP reporting to IFRS. The ultimate goal of GAAP is to ensure a company's financial statements are complete, consistent, and comparable. For example, if you ignored the accrual principle, you would record an expense only when you paid for it, which might incorporate a lengthy delay caused by the payment terms for the associated supplier invoice. Inflation accounting is a special technique used during periods of high inflation whereby statements are adjusted according to price indexes. These organizations are rooted in historic regulations governing financial reporting, which the federal government implemented following the 1929 stock market crash that triggered the Great Depression. "Acceptance From Foreign Private Issuers of Financial Statements Prepared in Accordance With International Financial Reporting Standards Without Reconciliation to U.S. GAAP," Page 7. In response, the federal government, along with professional accounting groups, set out to create standards for the ethical and accurate reporting of financial information. The 35-member Financial Accounting Standards Advisory Council (FASAC) monitors the FASB. The chart below includes only a couple of the variations that may affect how a business reports its financial information. GAAP may seem to take a "one-size-fits-all" approach to financial reporting that does not adequately address issues faced by distinct industries. GAAP is not the international accounting standard, which is a developing challenge as businesses become more globalized. There are some important differences in how accounting entries are treated in GAAP vs. IFRS. This means that you would be justified in deferring the recognition of some expenses, such as depreciation, until later periods. They also draw on established best practices governing cost, disclosure, matching, revenue recognition, professional judgment, and conservatism. This is the concept that a business should only record its assets, liabilities, and equity investments at their original purchase costs. "About GAAP. For example, GAAP stipulates how to file income statements, what financial periods to include, and how to report cash flow. Without regulatory standards, companies would be free to present financial information in whichever format best suits their needs. 162. Due to the thorough standards-setting process of the GAAP policy boards, it can take months or even years to finalize a new standard. Companies are still allowed to present certain figures without abiding by GAAP guidelines, provided that they clearly identify those figures as not conforming to GAAP. According to accounting historian Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants (AIA). Instead, independent boards assume the responsibility of creating, maintaining, and updating accounting principles. While the United States does not require IFRS, over 500 international SEC registrants follow these standards. The Generally Accepted Accounting Principles (GAAP) are a set of rules, guidelines and principles companies of all sizes and across industries in the U.S. adhere to. To ensure the boards operate responsibly and fulfill their obligations, they fall under the supervision of the Financial Accounting Foundation. Even though the U.S. federal government requires public companies to abide by GAAP, the government takes no part in developing these principles. The standards are prepared by the Financial Accounting Standards Board (FASB), which is an independent non-profit organization. You can unsubscribe at any time by contacting us at help@freshbooks.com. These components create consistent accounting and reporting standards, which provide prospective and existing investors with reliable methods of evaluating an organization's financial standing. Otherwise, you would have to recognize all expenses at once and not defer any of them. You may disable these by changing your browser settings, but this may affect how the website functions. She earned a bachelor of science in finance and accounting from New York University. accounting principles fundamental edition 24th pdf If you need income tax advice please contact an accountant in your area. accounting principles fundamental edition 22nd wild manual solutions shaw chiappetta john bank test principle reliability ken barbara help managerial students Accounting principles are the rules and guidelines that companies must follow when reporting financial data. principles Even though the FASB and IASB created the Norwalk Agreement in 2002, which promised to merge their unique set of accounting standards, they have made minimal progress. She is a paid member of Red Ventures Education's freelance review network. Brush up on more basic accounting terminology, Best Online Bachelor's Degrees in Accounting, Most Affordable Online Accounting Programs, Bachelor's Degrees in Forensic Accounting, Best Online Master's Degrees in Accounting, Most Affordable Masters in Accounting 2022, The Best Master's Degrees in Taxation 2022, Best Online Associate in Accounting Programs, Best Online Certificate Programs in Accounting, Best Bookkeeping Certificate Programs 2022, Difference Between Accounting and Finance, Financial Accounting Standards Board (FASB), Governmental Accounting Standards Board (GASB), Financial Accounting Standards Advisory Council, In certain situations, debt covenant violations may be listed as noncurrent, Unless lender agreement came before the creation of the balance sheet, all debt covenant violations must appear as current, Recognizes intangible assets at fair value, Only examines intangible assets if they can be associated with a future benefit, Not required to list expenses by function or nature, Must document expenses by either function or nature, Inventory write-down reversals are not permitted, Inventory write-down reversals are possible under some conditions, Included with other items on the income statement, Draft issue agenda and hold public meetings, Publish exposure draft for investor commentary, Propose new standards and invite business feedback, Weigh all public responses and revise accordingly, Conduct research on the subject of the new standard, Engage the public through published commentary, Create an exposure draft of the planned standard, Host a public hearing before the standard is finalized, 2022 Accounting.com, a Red Ventures Company. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBooks Privacy Policy. The calculation and purpose of book income in financial reporting and how it differs from taxable income. ", International Financial Reporting Standards. The GASB was established in 1984 as a policy board charged with creating GAAP for state and local government organizations. These investor reports from major publicly traded companies provide high-level examples of financial filings that follow GAAP: Discover more accounting definitions and terminology, The FASB's centralized reference tool is GAAP, Standards guidelines for financial reporting at federal government organizations, Links include research briefs, the annual technical plan, and a survey of users, Recommendations for small business financial reporting, Federal legislation regarding accounting and IT requirements, security, and disclosure requirements for public companies, The 10 generally accepted accounting principles include the following: - Principle of Regularity- Principle of Consistency- Principle of Sincerity- Principle of Permanence of Method- Principle of Non-Compensation- Principle of Prudence- Principle of Continuity- Principle of Periodicity- Principle of Full Disclosure- Principle of Utmost Good Faith. accounting GAAP is guided by ten key tenets and is a rules-based set of standards.

The procedures used in financial reporting should be consistent, allowing a comparison of the company's financial information. While non-GAAP reports may show more accurate figures for companies that experienced unusual one-time transactions, other businesses often list repeated earnings as one-time figures. The IASB and the FASB have been working on the convergence of IFRS and GAAP since 2002. This is the concept that the transactions of a business should be kept separate from those of its owners and other businesses. accounting weygandt principles edition 12th kieso chapters pdf papers volume working kimmel jerry wiley author So even when a company uses GAAP, you still need to scrutinize its financial statements. This is the concept that accounting transactions should be recorded in the accounting periods when they actually occur, rather than in the periods when there are cash flows associated with them. "The Hierarchy of Generally Accepted Accounting Principles. Many groups rely on government financial statements, including constituents and lawmakers.

Although these principles work to improve the transparency in financial statements, they do not provide any guarantee that a company's financial statements are free from errors or omissions that are intended to mislead investors. ", Financial Accounting Standards Board. GAAP is a set of procedures and guidelines used by companies to prepare their financial statements and other accounting disclosures. Only regulated and publicly traded businesses must adhere to GAAP. This is the concept that a business will remain in operation for the foreseeable future. Thus, it is easy enough to record the purchase of a fixed asset, since it was bought for a specific price, whereas the value of the quality control system of a business is not recorded. This prevents intermingling of assets and liabilities among multiple entities, which can cause considerable difficulties when the financial statements of a fledgling business are first audited. These 10 guidelines separate an organization's transactions from the personal transactions of its owners, standardize currency units used in reports, and explicitly disclose the time periods covered by specific reports.

Although these principles work to improve the transparency in financial statements, they do not provide any guarantee that a company's financial statements are free from errors or omissions that are intended to mislead investors. ", Financial Accounting Standards Board. GAAP is a set of procedures and guidelines used by companies to prepare their financial statements and other accounting disclosures. Only regulated and publicly traded businesses must adhere to GAAP. This is the concept that a business will remain in operation for the foreseeable future. Thus, it is easy enough to record the purchase of a fixed asset, since it was bought for a specific price, whereas the value of the quality control system of a business is not recorded. This prevents intermingling of assets and liabilities among multiple entities, which can cause considerable difficulties when the financial statements of a fledgling business are first audited. These 10 guidelines separate an organization's transactions from the personal transactions of its owners, standardize currency units used in reports, and explicitly disclose the time periods covered by specific reports.  While creating the financial reports, the accountants must strive for full disclosure.

While creating the financial reports, the accountants must strive for full disclosure.  accounting principles fundamental isbn wild abebooks john mcgraw hill education This is the reason that numerous footnotes are attached to financial statements. Both negatives and positives should be reported with full transparency and without the expectation of debt compensation. GAAP regulations require that non-GAAP measures be identified in financial statements and other public disclosures, such as press releases.

accounting principles fundamental isbn wild abebooks john mcgraw hill education This is the reason that numerous footnotes are attached to financial statements. Both negatives and positives should be reported with full transparency and without the expectation of debt compensation. GAAP regulations require that non-GAAP measures be identified in financial statements and other public disclosures, such as press releases. GAAP helps govern theworld of accounting according to general rules and guidelines. When a company holds investments such as shares, bonds, or derivatives on its balance sheet, it must account for them and their changes in value. The business is considered a separate entity, so the activities of a business must be kept separate from the financial activities of its business owners. Even though they appear transparent, non-GAAP figures can create confusion for investors and regulators. The cash basis of accounting does not use the matching the principle. Although it is not required for non-publicly traded companies, GAAP is viewed favorably by lenders and creditors. The ultimate goal of GAAP is to ensure a company's financial statements are complete, consistent, and comparable. David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. Accounting principles are the rules that an organization follows when reporting financial information. This asset amount is adjusted for inflation. There is plenty of room within GAAP for unscrupulous accountants to distort figures. Domestic public companies must use GAAP exclusively. GAAP incorporates three components that eliminate misleading accounting and financial reporting practices: 10 accounting principles, FASB rules and standards, and generally accepted industry practices. The Difference Between Principles-Based and Rules-Based Accounting. Both GAAP and IFRS require investments to be segregated into discrete categories based on asset type. The accounting standards have greatly amplified upon this concept in specifying an enormous number of informational disclosures.

U.S. law requires businesses releasing financial statements to the public and companies publicly traded on stock exchanges and indices to follow GAAP guidelines. Investopedia requires writers to use primary sources to support their work. Consistency principle. Due to the progress achieved in this partnership, the SEC, in 2007, removed the requirement for non-U.S. companies registered in America to reconcile their financial reports with GAAP if their accounts already complied with IFRS. GAAP is the set of accounting rules set forth by the FASB that U.S. companies must follow when putting together financial statements. This accounting principle refers to the intent of a business to carry on its operations and commitments into the foreseeable future and not to liquidate the business. The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices. For example, revenue should be reported in its relevant accounting period. Conservatism principle. The FASB and IASB want to merge their standards because they share the goal of pursuing accounting integrity. How Does US Accounting Differ From International Accounting? We also reference original research from other reputable publishers where appropriate. Necessary cookies will remain enabled to provide core functionality such as security, network management, and accessibility. Review our cookies information principles ebookon tilly larson This concept can be taken too far, where a business persistently misstates its results to be worse than is realistically the case. Since the U.S. does not fully comply with IFRS, global companies face challenges when creating financial statements. The principle assumes that the business will continue its operations in the future. The accountant has adhered to GAAP rules and regulations as a standard. International Business Machines Corporation (IBM) U.S. GAAP to Operating (Non-GAAP) Results Reconciliation (Unaudited) accounting principles edition 10th weygandt pdf kieso manual kimmel solutions concepts brv slides 14th intermediate bank test books powerpoint Depreciable Cost: What Does Depreciable Cost Mean? accounting errors concept aspect dual principles characteristics assumptions system suspense accounts types meaning classification balance business principle use rules commission GAAP incorporates the following 10 concepts: GAAP compliance makes the financial reporting process transparent and standardizes assumptions, terminology, definitions, and methods. On the recommendation of the American Institute of CPAs (AICPA), the FASB was formed as an independent board in 1973 to take over GAAP determinations and updates. As GAAP issues or questions arise, these boards meet to discuss potential changes and additional standards. It attempts to standardize and regulate the definitions, assumptions,and methods used in accounting across all industries. accounting principles Most financial institutions will require annual GAAP-compliant financial statements as a part of their debt covenants when issuing business loans. What Are the Generally Accepted Accounting Principles. Suzanne is a researcher, writer, and fact-checker.She holds a Bachelor of Science in Finance degree from Bridgewater State University and has worked on print content for business owners, national brands, and major publications. These include white papers, government data, original reporting, and interviews with industry experts. This is the concept that only those transactions that can be proven should be recorded. You can learn more about the standards we follow in producing accurate, unbiased content in our. ", Financial Accounting Standards Board. With non-GAAP metrics applied, the gross profit, income, and income margin increase, while the expenses decrease. The Governmental Accounting Standards Board (GASB) estimates that about half of the states officially require local and county governments to adhere to GAAP.

While valuing assets, it should be assumed the business will continue to operate. This is the foundation of the accrual basis of accounting. By clicking Accept All Cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts. Accounting Guidelines for Contingent Liabilities. In that situation, they might provide specially-designed non-GAAP metrics, in addition to the other disclosures required under GAAP. In the U.S., it has been established by the Financial Accounting Standards Board (FASB) and the American Institute of Certified Public Accountants (AICPA). GAAP aims to improve the clarity, consistency, and comparability of the communication of financial information. As a result, most companies in the United States do follow GAAP. All 50 state governments prepare their financial reports according to GAAP. The IFRS began almost 50 years ago under a different name. Federal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, laws enforced by the U.S. Securities and Exchange Commission (SEC) that target public companies. GAAP compliance is ensured through an appropriate auditor's opinion, resulting from an external audit by a certified public accounting (CPA) firm. The historical cost is reported on the financial statements. The full details of the financial information should be disclosed including negatives and positives. These wait times may not work to the advantage of companies complying with GAAP, as pending decisions can affect their reports. Without these standards and practices, businesses could publish their reports differently, creating discrepancies, confusion, and potential opportunities for fraud. The Great Depression in 1929, a financial catastrophe that caused years of hardship for millions of Americans, was primarily attributed to faulty and manipulative reporting practices among businesses. For example, the commissions for sales should be recorded in the same accounting period that sales income was made (and not when they were paid). ", Financial Accounting Foundation. "Comparability In International Accounting Standards: A Brief History.". By applying similar standards in the reporting process, accountants can avoid errors or discrepancies. Lizzette Matos is a certified public accountant in New York state. This is quite a vague concept that is difficult to quantify, which has led some of the more picayune controllers to record even the smallest transactions. With such a prominent difference in approach, dozens of other discrepancies surface throughout the standards. Revenue recognition principle. It directs the accountant to anticipate the losses and choose the alternative that will result in less net income and/or less asset amount. Financial Accounting Standards Board (FASB), International Financial Reporting Standards (IFRS). In the Black vs in the Red: What Does in the Black and in the Red Mean? This may qualify as the most glaringly obvious of all accounting principles, but is intended to create a standard set of comparable periods, which is useful for trend analysis. The importance of GAAP lies in the uniformity, comparability, and transparency of financial documents. However, the non-GAAP numbers include pro forma figures, which do not include one-time transactions. How Does Financial Accounting Help Decision-Making? External parties can easily compare financial statements issued by GAAP-compliant entities and safely assume consistency, which allows for quick and accurate cross-company comparisons. To facilitate comparisons, the financial information must follow the generally accepted accounting principles. They form the basis upon which the complete suite of accounting standards have been built. IFRS is currently used in 166 jurisdictions. For instance, when the COVID-19 pandemic hit, the board members met to address how governments and businesses must report the financial effects of the pandemic. She has worked in the private industry as an accountant for law firms and ITOCHU Corporation, an international conglomerate that manages over 20 subsidiaries and affiliates. Companies can use this information to their advantage and present totals that predict how their businesses will perform in the future. However, about one third of private companies choose to comply with these standards to provide transparency. It also facilitates the comparison of financial information across different companies. It is often compared with the International Financial Reporting Standards (IFRS), which is considered more of a principles-based standard. accounting accountants principles london GAAP does not allow for inventory reversals, while IFRS permits them under certain conditions. For example, state and local governments may struggle with implementing GAAP due to their unique environments. accounting principles basic statements bookkeeping financial hrprobe gaap accrual hrbuch ultimate entry double guide Companies can still suffer from issues beyond the scope of GAAP depending on their size, business categorization, location, and global presence. There are ten principles that can help you understand the mission of the GAAP standards and rules. Revenue recognition is a generally accepted accounting principle (GAAP) that identifies the specific conditions in which revenue is recognized. This is the concept that you should record a transaction in the accounting records if not doing so might have altered the decision making process of someone reading the company's financial statements. Economic entity principle. accounting principles volume edition weygandt jerry Conceptually, GAAP is more rules-based while IFRS is more guided by principles. Other differences appear in the treatment of extraordinary items and discontinued operations. There are 10 general concepts that lay out the main mission of GAAP. This site uses cookies. IFRS rules ban the use of last-in, first-out (LIFO) inventory accounting methods. March 4, 2022 | Accounting.com Staff "SEC Scrutiny of Non-GAAP Financial Measures.". "Statement of Financial Accounting Standards No. International Accounting Standards are an older set of standards that were replaced by International Financial Reporting Standards (IFRS) in 2001. Governments and public companies abide by these accounting principles to ensure all documents present consistent, accurate, and clear reports. Harvard Law School Forum on Corporate Governance. The board's processes and communications are available for public review. GAAP is focused on the accounting and financial reporting of U.S. companies. The accountants should enter all items in exactly the same way that it has been fixed. We use analytics cookies to ensure you get the best experience on our website. Some companies may report both GAAP and non-GAAP measures when reporting their financial results. This is the concept that a business should report the results of its operations over a standard period of time.

"Who We Are. GAAP is a set of rules used for helping publicly-traded companies create their financial statements. What Is the Matching Principle and Why Is It Important? While each financial reporting framework aims to provide uniform procedures and principles to accountants, there are notable differences between them. It is important for the construction of financial statements that show what actually happened in an accounting period, rather than being artificially delayed or accelerated by the associated cash flows. While GAAP accounting strives to alleviate incidents of inaccurate reporting, it is by no means comprehensive. This concept is of prime interest to auditors, who are constantly in search of the evidence supporting transactions. IFRS is a more international standard, and there have been recent efforts to transition GAAP reporting to IFRS. The ultimate goal of GAAP is to ensure a company's financial statements are complete, consistent, and comparable. For example, if you ignored the accrual principle, you would record an expense only when you paid for it, which might incorporate a lengthy delay caused by the payment terms for the associated supplier invoice. Inflation accounting is a special technique used during periods of high inflation whereby statements are adjusted according to price indexes. These organizations are rooted in historic regulations governing financial reporting, which the federal government implemented following the 1929 stock market crash that triggered the Great Depression. "Acceptance From Foreign Private Issuers of Financial Statements Prepared in Accordance With International Financial Reporting Standards Without Reconciliation to U.S. GAAP," Page 7. In response, the federal government, along with professional accounting groups, set out to create standards for the ethical and accurate reporting of financial information. The 35-member Financial Accounting Standards Advisory Council (FASAC) monitors the FASB. The chart below includes only a couple of the variations that may affect how a business reports its financial information. GAAP may seem to take a "one-size-fits-all" approach to financial reporting that does not adequately address issues faced by distinct industries. GAAP is not the international accounting standard, which is a developing challenge as businesses become more globalized. There are some important differences in how accounting entries are treated in GAAP vs. IFRS. This means that you would be justified in deferring the recognition of some expenses, such as depreciation, until later periods. They also draw on established best practices governing cost, disclosure, matching, revenue recognition, professional judgment, and conservatism. This is the concept that a business should only record its assets, liabilities, and equity investments at their original purchase costs. "About GAAP. For example, GAAP stipulates how to file income statements, what financial periods to include, and how to report cash flow. Without regulatory standards, companies would be free to present financial information in whichever format best suits their needs. 162. Due to the thorough standards-setting process of the GAAP policy boards, it can take months or even years to finalize a new standard. Companies are still allowed to present certain figures without abiding by GAAP guidelines, provided that they clearly identify those figures as not conforming to GAAP. According to accounting historian Stephen Zeff in The CPA Journal, GAAP terminology was first used in 1936 by the American Institute of Accountants (AIA). Instead, independent boards assume the responsibility of creating, maintaining, and updating accounting principles. While the United States does not require IFRS, over 500 international SEC registrants follow these standards. The Generally Accepted Accounting Principles (GAAP) are a set of rules, guidelines and principles companies of all sizes and across industries in the U.S. adhere to. To ensure the boards operate responsibly and fulfill their obligations, they fall under the supervision of the Financial Accounting Foundation. Even though the U.S. federal government requires public companies to abide by GAAP, the government takes no part in developing these principles. The standards are prepared by the Financial Accounting Standards Board (FASB), which is an independent non-profit organization. You can unsubscribe at any time by contacting us at help@freshbooks.com. These components create consistent accounting and reporting standards, which provide prospective and existing investors with reliable methods of evaluating an organization's financial standing. Otherwise, you would have to recognize all expenses at once and not defer any of them. You may disable these by changing your browser settings, but this may affect how the website functions. She earned a bachelor of science in finance and accounting from New York University. accounting principles fundamental edition 24th pdf If you need income tax advice please contact an accountant in your area. accounting principles fundamental edition 22nd wild manual solutions shaw chiappetta john bank test principle reliability ken barbara help managerial students Accounting principles are the rules and guidelines that companies must follow when reporting financial data. principles Even though the FASB and IASB created the Norwalk Agreement in 2002, which promised to merge their unique set of accounting standards, they have made minimal progress. She is a paid member of Red Ventures Education's freelance review network. Brush up on more basic accounting terminology, Best Online Bachelor's Degrees in Accounting, Most Affordable Online Accounting Programs, Bachelor's Degrees in Forensic Accounting, Best Online Master's Degrees in Accounting, Most Affordable Masters in Accounting 2022, The Best Master's Degrees in Taxation 2022, Best Online Associate in Accounting Programs, Best Online Certificate Programs in Accounting, Best Bookkeeping Certificate Programs 2022, Difference Between Accounting and Finance, Financial Accounting Standards Board (FASB), Governmental Accounting Standards Board (GASB), Financial Accounting Standards Advisory Council, In certain situations, debt covenant violations may be listed as noncurrent, Unless lender agreement came before the creation of the balance sheet, all debt covenant violations must appear as current, Recognizes intangible assets at fair value, Only examines intangible assets if they can be associated with a future benefit, Not required to list expenses by function or nature, Must document expenses by either function or nature, Inventory write-down reversals are not permitted, Inventory write-down reversals are possible under some conditions, Included with other items on the income statement, Draft issue agenda and hold public meetings, Publish exposure draft for investor commentary, Propose new standards and invite business feedback, Weigh all public responses and revise accordingly, Conduct research on the subject of the new standard, Engage the public through published commentary, Create an exposure draft of the planned standard, Host a public hearing before the standard is finalized, 2022 Accounting.com, a Red Ventures Company. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBooks Privacy Policy. The calculation and purpose of book income in financial reporting and how it differs from taxable income. ", International Financial Reporting Standards. The GASB was established in 1984 as a policy board charged with creating GAAP for state and local government organizations. These investor reports from major publicly traded companies provide high-level examples of financial filings that follow GAAP: Discover more accounting definitions and terminology, The FASB's centralized reference tool is GAAP, Standards guidelines for financial reporting at federal government organizations, Links include research briefs, the annual technical plan, and a survey of users, Recommendations for small business financial reporting, Federal legislation regarding accounting and IT requirements, security, and disclosure requirements for public companies, The 10 generally accepted accounting principles include the following: - Principle of Regularity- Principle of Consistency- Principle of Sincerity- Principle of Permanence of Method- Principle of Non-Compensation- Principle of Prudence- Principle of Continuity- Principle of Periodicity- Principle of Full Disclosure- Principle of Utmost Good Faith. accounting GAAP is guided by ten key tenets and is a rules-based set of standards.