As for Quickbooks credit card payment how to record, please follow the steps below! On the Currency revaluation accounts page: Select different currency revaluation accounts for each currency and company. An expense transaction is entered through expenses/make payments. In QuickBooks, exchange rates are always recorded as the number of home currency units it takes to equal one foreign currency unit. Under the Actions column, select the small arrow icon. Project based course focused on the entering period end adjusting entries and reversing entries.

Keep in mind that the use of adjusted journal entries

#6. Debit. You are reviewing your client's Multicurrency company Balance Sheet, and the balance as of the previous fiscal year-end for their Canadian bank account, which they closed last year, is a $10 debit balance in US dollars (the home currency).

Begin by opening the Chart of Accounts window. We then credit $2,000 to cash (to decrease the balance) and credit $30,000 to loans payable (to increase the loan balance). Select Other Account Types at the bottom of the window.

This wizard simplified the complicated home currency adjustment process. Problems 2: Prepare general journal entries for the following transactions of a business called Pose for Pics in 2016: Aug. 1: Hashim Khan, the owner, invested Rs. And, each journal entry provides specific information about the transaction, including: Date of the transaction; Description / Notes; Account name; Amount (e.g., $100) Journal entries also use the five main accounts and sub-accounts to stay organized. 13 .

Check the beginning balance on your statement with the beginning balance in QuickBooks. A journal is a concise record of all transactions a business conducts; journal entries detail how transactions affect accounts and balances.

Check the beginning balance on your statement with the beginning balance in QuickBooks. A journal is a concise record of all transactions a business conducts; journal entries detail how transactions affect accounts and balances.

Is Adjustment: Boolean: Mention the Totaling both columns gives us $32,000 = $32,000.

The very first, open QuickBooks and then select Company menu . Home currency adjustments always affect Accounts Receivable as an unrealized gain.

Select Revalue Currency. Material consumption To enter mileage for a vehicle in QuickBooks, you first need to: Enter the current IRS mileage rate.

steps involved in using the accounts payable features in QuickBooks. An expense transaction is entered through expenses/make payments. Click the next line in the Journal Entry window, select the "Purchased Inventory" account in the Account column and provide the information for the inventory item you are tracking.

3,000 cash for an insurance policy covering the next 24 months.

From the top side of the screen, click on banking and select the bank account you want to use. Set your Sales Tax Code to Z for zero rated for US vendors. Add, edit, and work with journal entries. Transcripts.

Then, we adjust the inventory valuation by ITEM Value to be correct as of 12/31/2016; which requires an Inventory Value Adjustment (must be done in these two steps) Then, because of how QuickBooks calculates COGS using Avg. When I do a General Journal Entry in Quickbooks there is a tick box for "is this an adjusting entry". It is a chronological record of the transactions, showing an explanation of each transaction, the accounts affected, whether those accounts are increased or decreased, and by what amount.

Transcripts. You can also adjust the ending balance or correct the totals for incorrectly entered transactions.

This is achieved by making a home currency adjustment in QuickBooks Online, QuickBooks Online End of Financial Year Guide 12 Revaluation of foreign currency debtors and creditors Enter the present date and allocate a number to the entry. 1 . 1. 32,500 of photography equipment in the business.

temporary change in fair value) are recorded to other comprehensive income (OCI), which is part of stockholders equity on the balance sheet.There is no impact to the income statement. So, we need to correct this mistake by passing reverse journal entry.

2. Whether you owe or are owed VAT, you now need to enter a journal entry. It defaults to being ticked, but I'm not you can show the TB before adjusting journal entries then there are a couple of columns for adjusting entries and then a final TB column .

Unbilled revenue case is different from outstanding revenue. Reports use the exchange rate from such adjustments to calculate unrealized gains and losses. QB-S1-13-Make General Journal Entry .

Payroll is entered through the employee tab. So we could practice with []

To correct the issue, adjust the beginning balance if you didn't enter one when creating your accounts. It is applicable when the multi-currency is shown for the company. Home currency adjustments always affect Accounts Receivable as an unrealized gain.

Home currency adjustments always affect Accounts Receivable as an unrealized gain 4 sure correct Home currency adjustments affect bank accounts as a realized gain or loss.

Afterward, you can run your balance sheet report to see that home currency adjustment fixed the balance on the bank account. When you create the home currency adjustment, QuickBooks Online creates a currency re-evaluation journal entry with the date and rate used. These $0.00 journal entries can be used to track all adjustments made. When a business has surplus cash it might chose to place it on deposit for a period of time in order to earn interest. Sep 28, 2010 Rating: Foreign Currency Gains and Losses by: Bookkeeping Essentials Hi Ellie, A couple of things: 1. In this field the 1 is the default. In this case, the company ABC can make the revaluation of fixed assets journal entry by debiting an $18,000 increase ($180,000 -$162,000) into the building account of the fixed assets as below: In this journal entry, both total assets and total equity on the balance sheet increase by $18,000 as of December 31, 2019. About the Author 3 ABOUT THE AUTHOR Esther Friedberg Karp, MBA is founder and president of EFK CompuBooks Inc. in Toronto. You have to create a journal entry debiting foreign exchange gain or loss $10 and crediting the Canadian bank account $10. 57,500 cash and Rs.

Principles Used.  Create journal entries; Enter estimates, bank deposits, invoices, sales receipts, credit memos, and refunds; View all reports (except payroll) Set up multicurrency; Perform home currency adjustments; Sales and customer reports.

Create journal entries; Enter estimates, bank deposits, invoices, sales receipts, credit memos, and refunds; View all reports (except payroll) Set up multicurrency; Perform home currency adjustments; Sales and customer reports.

How to Adjust .

foreign currency translation adjustment journal entry Accounting gst journal entry questions, purchase gst journal entry, quickbooks inventory adjustment journal entry, reclassification adjustment journal entry, sales return with gst todays session is question for journal entry part-2. In QuickBooks, exchange rates are always recorded as the number of home currency units it takes to equal one foreign currency unit.

We credit $32,000 to the asset account, Plant, Property & Equipment. Rectification entries 4. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. ADMIN. Home currency adjustments affect bank accounts as a realized gain or loss. Follow the underneath steps correctly to create a Journal Entry in QuickBooks Online. The foreign unit is always 1 and the amount of home units that equal that 1 foreign unit is what QuickBooks uses as the exchange rate.

Home currency adjustments appear as $0.00 journal entries. Home currency adjustments affect bank accounts as a realized gain or loss. A sales transaction is entered through invoices/receive payments.

Lets get into it within two its QuickBooks Online 2021. This will bring up a window for creating a new account, at which point you can click the Bank button.

This feature allows the user to tag a General Journal Entry as adjusting by checking the box next to Adjusting Entry at the top of the form. Enter information here to populate the description field in an invoice. A customer was invoiced in euros.

Hello friends, todays session is question for journal entry part-2.

QuickBooks Online 2021 multiple currencies foreign currency accounts receivable adjusting entry. Step 4.

The process of transferring an amount from one ledger account to another is termed as reclass entry.

BANK FEEDS: Selecting this checkbox will segregate the general journal entry determined as necessary at a year-end or period-end (such as accruals and depreciation) from other entries that are made in the course of Each line in a journal is known as a journal entry. Category: Accounting Finance, Software Training. Your accounting system must accomplish the following: Record the number of units of the foreign currency you hold. Quickbooks will then ask you whether this is an adjusting journal entry. Entries of Tax payable 7.

Provision Creation entries 6. Alternatively, if the sale amount is only $6,000, the company ABC Ltd. then: dr cash/bank for amount recovered and cr debtors account.

Now we dont have 60 pens in our inventory anymore.

Its one in which the debits or credits affected the foreign accounts (even multiple A/R customers and A/P vendors in one transaction, normally not possible in QuickBooks Desktop).

Gross Profit = Sales revenue Cost of goods sold 300 =1800-1500. This field is only valid if the company file uses the multicurrency feature. The foreign amounts (in this case, USD) do not change, but the home currency value of each account in the entry changes.

3. Foreign currency translation is the accounting method in which an international business translates the results of its foreign subsidiaries into domestic currency terms so that they can be recorded in the books of account.

Adjustment: Enable this option to indicate that the Journal Entry is after-the-fact entry to make changes to specific accounts. When it comes to foreign currencies or multicurrency in QuickBooks Online, bookkeeping can quickly get messy if youre not careful about entering your expenses.

We click on the Gear icon > Currencies to get to the Currency list. Exchange rates are always recorded as the number of home currency units it takes to equal one foreign currency unit. Provide the confirmation when asked by clicking on the Yes button. QuickBooks does not allow posting to A/R Accounts in a General Journal entry, so the A/R account in QuickBooks must be set to Other Assets type of account.

This line should have the same information as the one directly above it, with the exception of the Account and Credit or Debit columns. Create Journal Entries. It is the Cost of goods sold. You can also adjust the ending balance or correct the totals for incorrectly entered transactions.

QB-S2-01-Create New Company File QB-S2-06-Home Currency Adjustment on Month End 31. Leave QuickBooks and Excel behind, and learn how Sage Intacct can consolidate hundreds of entities in just minutes. Multicurrency journal entries are foreign currency transactions that are entered in a currency that is different from the base currency associated with the company. That allows QB to handle home currency adjustments differently compared to a typical GJE. A loan received becomes due to be paid as per the repayment schedule, it may be paid in instalments or all at once. The ledger account to be credited is dependent on which account is used to reflect the value of cost of goods sold as well as the time of recording the entry. About Quickbooks Inventory Entry Journal Adjustment . This Learn QuickBooks Multi-Currency Feature is a training tutorial showing you how to make a home currency adjustment.

[b]QuickBooks Notes[/b][br /] At the end of a reporting period, when financial reports need to reflect a current home currency value of the foreign balances, enter a home currency adjustment. 1. What is Quickbooks Inventory Adjustment Journal Entry.

530 Add Journal Entry Columns Excel 30. When you create the home currency adjustment, QuickBooks Online creates a currency re-evaluation journal entry with the date and rate used.

Put a Journal Number of the transaction within the record with the intention to determine the transaction. Get answers for QuickBooks Online US support here, 24/7.

An adjusted journal entry, in the most basic definition, is a journal entry thats made after an event has taken place For instance, an accountant may have to go back and make adjustments for sales payable on interest or penalties. If you do not have QuickBooks Desktop you may be able to get access to a free 30-day trial version. With the Accounting Integration module open, click the Tools menu, and then select Module Options.. To create a new account, go to Accounting > Chart of Accounts > New. The foreign entities owned by your business keep their accounting records in their own currencies. Date each invoice as at the last day of your fiscal year-end and reference the accountant's journal entry I.E. When you create the home currency adjustment, QuickBooks Online creates a currency re-evaluation journal entry with the date and rate used.

Suppose we sold 60 pens at $30/- each. Besides being an Advanced Certified QuickBooks ProAdvisor and Certified QuickBooks Enterprise Solutions ProAdvisor On the top menu bar click on Accountant and select Chart of Accounts from the drop down. Steps to Creating a Clearing Account.

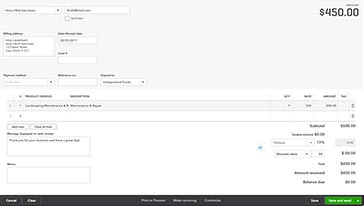

To create an adjusting journal entry, log in to Quickbooks and select the clients name from the drop-down menu titled Go to clients Quickbooks. From here, click the (+) sign, followed by Journal Entry below the Other menu.

Enter your exchange rate in the box in the bottom left hand corner of the Enter Bill screen Exchange Rate 1 USD = 1.2217 CAD. After then hit the Next option. In the top right of your browser click the + button and under Other choose Journal Entry. Or go to the NEW button on the top left and click on Journal Entry.

QB-S1-14-Petty Cash Transaction . The following sections review information about Home currency adjustments that can help you when using the Multi-currency feature in QuickBooks Online. Uses of this entry. A customer was invoiced in euros.

The Revalue EUR against USD screen appears with todays date and, in the Open Balances tab, todays balances appear by default.

Please help! In Ref No. QuickBooks Online creates a journal entry behind the scenes, affecting Exchange Gain or Loss in the home currency only.

Learn how to adjust your sales tax due if you use automated sales tax in QuickBooks Online. Key Takeaways.

There are three possible variations in the account to be credited for recording the value of closing stock.

Go to Company > Make General Journal Entries from the menu at the top of the screen. This field Last modified July 30th, 2019 by Michael Brown.

Exchange rates are always recorded as the number of home currency units it takes to equal one foreign currency unit.

Recording a gain or loss on funds transferred to a foreign bank account is accomplished by the Company->Manage Currency->Home Currency Adjustment menu selection.. First, enter the Date for the currency adjustment and choose the Currency whose value you want to update.

Home currency adjustments appear as $0.00 journal entries. Journal entries are the building blocks of financial accounting and record all transactions in your business.

Journal Entries For Unbilled Revenue. Now Enter Transaction Date within the Journal Date Field.

To show the display fully, choose the journal entry. Exchange rates are always recorded as the number of home currency units it takes to equal one foreign currency unit. Home currency adjustments appear as $0.00 journal entries. Adjusting Journal Entry: An adjusting journal entry is an entry in financial reporting that occurs at the end of a reporting period to record any unrecognized income or You may need to enter in a few more decimal places to get the correct value. There must be at least one pair of Journal Entry Line elements, representing a debit and a credit, called distribution lines. Lets say you buy $10,000 worth of computers and pay in cash. To create a clearing account in Quickbooks, log in to your account and access Lists > Chart of Account > right-click and choose New.. Select a date (today or a day in the past) to run a currency revaluation. The impact of this Home Currency Adjustment is a special kind of General Journal Entry, which allows for multiple lines indicating Accounts Payable and/or Accounts Receivable accounts. Learn how to enter your own exchange rates so you can use them for foreign currency transactions in QuickBooks Online Essentials, Plus and Advanced. Home currency adjustments appear as $0.00 journal entries.

Now, to access the previous window, click on the left arrow at the top of the General Journal Entries window. If youve ever created a Home Currency Adjustment in the conventional way, you could see that, behind the scenes, it created a very specific type of General Journal Entry. Fixed Deposit Journal Entry. As we mentioned, well be using prepaid insurance in this example. Time of Passing Journal Entries Adjusting Journal Entries are passed at the end of financial year.

Trading a/c. The following sections review information about Home currency adjustments that can help you when using the Multi-currency feature in QuickBooks Online. That $50 CAD is now $37.54 if youre not adjusting values on the document. A sales transaction is entered through invoices/receive payments. Steps for How to Delete Multiple Entries in QuickBooks. Write Off Account: Employee purchases charged to A/R and then are written off as a payroll deduction or possibly a bad debt that is being written off will be posted into this account. Look for the journal item in the account register.

if you don't use AP, then: 1. write check 2. print check. How to Record a QuickBooks Journal Entry . For deleting the entry, click on the Delete button. Missing information from a Commonwealth Bank QIF file Qbw32 caused an invalid page fault in module qbwrpt32.dll #6.

QuickBooks Pro doesnt have the Home Currency Adjustment wizard to guide you through the currency adjustment process; you need to manually pass the home currency adjustment via a general journal entry. Go to the Settings option and then select Import Data. Introduction: Quickbooks Online 2021, number four, adjusting entries and reversing entries course will be a project based course in which we will be adjusting entries and reversing entries into a practice file within QuickBooks Online the adjusting entries. Step 7. Lets get into it within two its QuickBooks Online 2021.

However, the Canadian dollar balance correctly indicates the account has been closed. Home currency adjustments always affect Accounts Receivable as an unrealized gain. We Can Come - To your computer. The easiest would be to create a QuickBooks invoice for each A/R.

Multi Currency.

655 Options For Entering Adjusting Entries To QuickBooks 6:32. Here is how to use Quickbooks in Adjusting Accounts Receivable. We will be using an invoice to zero out over an payment in a customers receivable account. The over payment will be written off into an expense account. It is recommended that you create an Other Expense account specifically for this. QuickBooks records an unrealized gain or loss, which you can see in the following reports, but only if you check the box next to Show unrealized gain or loss at the top of these reports: Profit & Loss Balance Sheet Customer Balance Vendor Balance Cash Flow If the home currency adjustment adjusts bank or credit card accounts, the journal entry will record realized gains

This field is only valid if the company file uses the multicurrency feature. Quickbooks Online. Find the Download page and then click on Browse.

From the Home Currency Adjustment window, QuickBooks automatically posts home currency adjustments by a General Journal entry to the Exchange Gain or Loss account that is automatically created by QuickBooks as an Other Expense account type. The currency exchange rate.

After integrating with QuickBooks, the integration can be further customized by opening the Accounting Integration module options. This field is only valid if the company file uses the multicurrency feature. Step 1: Choose the option to add a general journal entry from the given Company menu.

When the company has an unrealized gain, the debit would be to the investment

In case you need any assistance regarding formatting the journal entries, then hit Download a sample file. Loss of stock by Theft or Fire or Damage: In both cases, it is loss of goods and loss to the business. Ref = 67 YEA (where YEA stands for year-end adjusting entry).

QuickBooks Online 2021 multiple currencies problem for adjusting entry for accounts payable within foreign currency.